Happy Tax Day! The tax industry (by which I primarily mean its largest player, Intuit) sucks.1 As a whole, the industry is an excellent example of rent-seeking behavior, and not one I wish to encourage with my patronage. So I tried out a few options when filing my 2021 taxes, and found out a few interesting things along the way2.

Contents

Introduction

In the past, I’ve fluctuated between filling out paper forms from the IRS and, more recently, having TurboTax do my taxes for me. This year, I’m tired of TurboTax’s shenanigans, and they no longer (appear to?) participate in the Free File program, so I’d be paying through the nose for it. In the interest of finding something better, I tried a few other providers. Also, it’s possible that this will be my last year that I’ll fall in the income range where I’ll be eligible for the Free File program, so I figured I’d try out some of the free-as-in-beer software while it’s available to me.

I <3 open source, so I tried out the two major open-source contenders:

USTaxes.org is a modern-feeling GPL3-licensed web/desktop app written with React. It’s very usable, though certainly won’t cover every use case for everyone, as its scope is currently fairly limited. I did my taxes with their web version, but there’s a desktop version built with Tauri, if you want to make extra sure your data never leaves your computer.

OpenTaxSolver is a desktop application, GPL2 licensed, written in C. It exposes a very neat plaintext file format for managing tax forms, and then uses that data to generate the final fillable PDFs. However, its interface feels slightly archaic, as does its ecosystem: Sourceforge, Subversion3, and this excellent logo. However, that’s not a bad thing in my book—the implementation also tends towards Boring (C, Makefiles, limited dependencies), which is definitely a plus4!

More about OpenTaxSolver

Here’s a summary from their website:

OpenTaxSolver (OTS) is a set of programs and templates for helping you fill out your income tax forms. It performs the tedious arithmetic. OTS is intended to assist those who normally prepare their tax forms themselves, and who generally know on which lines to enter their numbers. It is meant to be used in combination with the instruction booklet corresponding to a given form.

This package contains programs and templates for:

- US-1040 - which also does the Schedules A, B, D, and forms 8949.

- Schedule C for US-1040.

- State Income Taxes for Ohio, New Jersey, Virginia, Pennsylvania, Massachusetts, North Carolina, and California taxes updated for the 2021 Tax-Year.

Also contains an Automatic PDF Form-Fillout function:

- Supports all Federal Forms and State Forms. Saves time by filling out many of the numbers. You may still need to enter some information or check boxes that are not handled by OTS. Tested to work properly with many PDF viewers.

- You can edit your forms with Libre-Office.

Here’s an architecture diagram from their website:

Their file format is really interesting. Here’s a snippet from my file from this year:

Title: US Federal 1040 Tax Form - 2021

{ --- Your Filing Status & Exemptions --- }

Status Single { Single, Married/Joint, Head_of_House, Married/Sep, Widow(er) }

You_65+Over? N { Were you born before January 2, 1957 ? (answer: Yes, No) }

You_Blind? N { Are you blind ? (answer: Yes, No) }

Spouse_65+Over? N { Was Spouse born before January 2, 1957 ? (answer: Yes, No) }

Spouse_Blind? N { Is Spouse blind ? (answer: Yes, No) }

Dependents 1 { Number of Dependents, (answer: 1, 2, 3, 4, 5, 6, 7, 8, 9, ...)

self=1, spouse, etc. }

VirtCurr? N { During 2021, did you buy/sell/exchange/trade any Virtual Currency ? (answer: Yes, No) }

{ ---- Income ---- }

{ -- Wages, salaries, tips (W-2's Box-1). -- }

L1 12345.67

;

{ --- Interest --- }

{ -- Tax-Exempt Interest. (Only used for SocialSecurity calculations). --

(Any private activity bond interest exempt from regular tax, is entered under Schedule 2 below.) }

L2a ;

{ -- Taxable Interest -- 1099-INT(s) box 1 }

L2b 20.13

;

{ --- Dividends --- }

{ -- Qualified Dividends 1099-DIV box 1b -- }

L3a 72.97

;

{ -- Ordinary Dividends 1099-DIV box 1a. -- }

L3b 120.95

;

{ --- Other Income & Credits --- }

L4a ; { IRA distributions. }

L4b ; { Taxable IRA distributions. }

L5a ; { Pensions, Annuites. }

L5b ; { Taxable Pensions, Annuites. }

L6a ; { Social Security benefits. Forms SSA-1099 box-5. }

CharityCC 200 ; { Charity contributions by Cash or Check. }

CharityOT ; { Charity contributions Other Than cash or check. }

CharityCO ; { Charity contributions CarryOver from prior year. }

L13 ; { Qualified business income deduction. }

L19 ; { Child tax credit/credit for other dependents. }

L25a 1234.56 ; { Federal income tax withheld, from W-2's, box-2. }

L25b ; { Federal income tax withheld, from 1099's. }

L25c ; { Federal income tax withheld, from other forms. }

L26 ; { Estimated tax payments made for the year. }

As a control group, I compared the results with several other providers:

TurboTax may be Satan incarnate, but I wanted to include it for completeness’ sake.

FreeTaxUSA.com is a frequently recommended competitor to TurboTax.

OLT.com was the only Free File provider that would also file my state returns for free.

Not under consideration this time around:

Filling out forms myself: While doing my taxes five consecutive times gave me a pretty good overview of what I’d need to do, I wasn’t prepared to attempt doing my taxes unassisted this year. Perhaps next year, since I should be able to mostly copy/paste from my 2021 tax return.

Free File Fillable Forms https://www.freefilefillableforms.com/home/default.php

A paid tax preparer like H&R Block (which I’ve heard is the TurboTax of in-person tax preparers) or your local CPA. This option tends to be prohibitively expensive, and won’t likely end up saving me much time.

Getting started

UsTaxes.org

Perhaps unsurprisingly, the open-source version was the easiest to sign up for, in that no signup whatsoever is required. (This does mean that they may lose your data if you start a return and don’t complete it. It wasn’t entirely clear to me how the data was stored—localStorage mostly, I think?—but I avoided refreshing the page just in case.) Just visit their website and go!

Otherwise, you can download their desktop app and run locally:

https://github.com/ustaxes/UsTaxes/releases

Selecting and downloading an appropriate executable for one’s platform is

perhaps the least user-friendly part of the process. The download takes you

straight to GitHub releases, with no indication of whether you want the .msi

(Windows), the .dmg (MacOS), the .deb (Debian/Ubuntu/Mint/…), the

.AppImage, …. While I might feel comfortable recommending UsTaxes.org to my

parents from a general usability standpoint, I wouldn’t expect them to

necessarily figure out GitHub Releases just to install the software.

OpenTaxSolver

Download OpenTaxSolver from http://opentaxsolver.sourceforge.net/download2021.html, extract and run:

tar xf OpenTaxSolver2021_19.07_linux64.tgz

cd OpenTaxSolver2021_19.07_linux64

./Run_taxsolve_GUI

Documentation is available online: http://opentaxsolver.sourceforge.net/usage.html

There are prebuilt versions, and some distros have it packaged. Still, not ready for non-nerds.

Paid providers

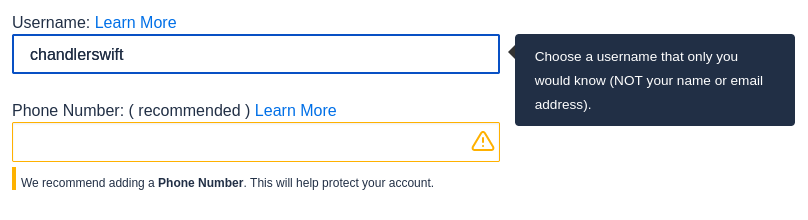

All three required me to sign up for an account, but there was nothing noteworthy about the process for any of them. Except FreeTaxUSA, which is convinced that usernames are secrets? (Shh, don’t tell anyone!)

Each suggests, with varying degrees of intensity, that I add a phone number to “secure my account”—presumably with SMS-based 2fa. I didn’t dig around in any menus to figure out if they supported TOTP or not. I get enough SMS spam as it is, so I declined giving any of the three my phone number. Based on the number of promotional emails I’ve gotten this week from Intuit, this may have been wise.

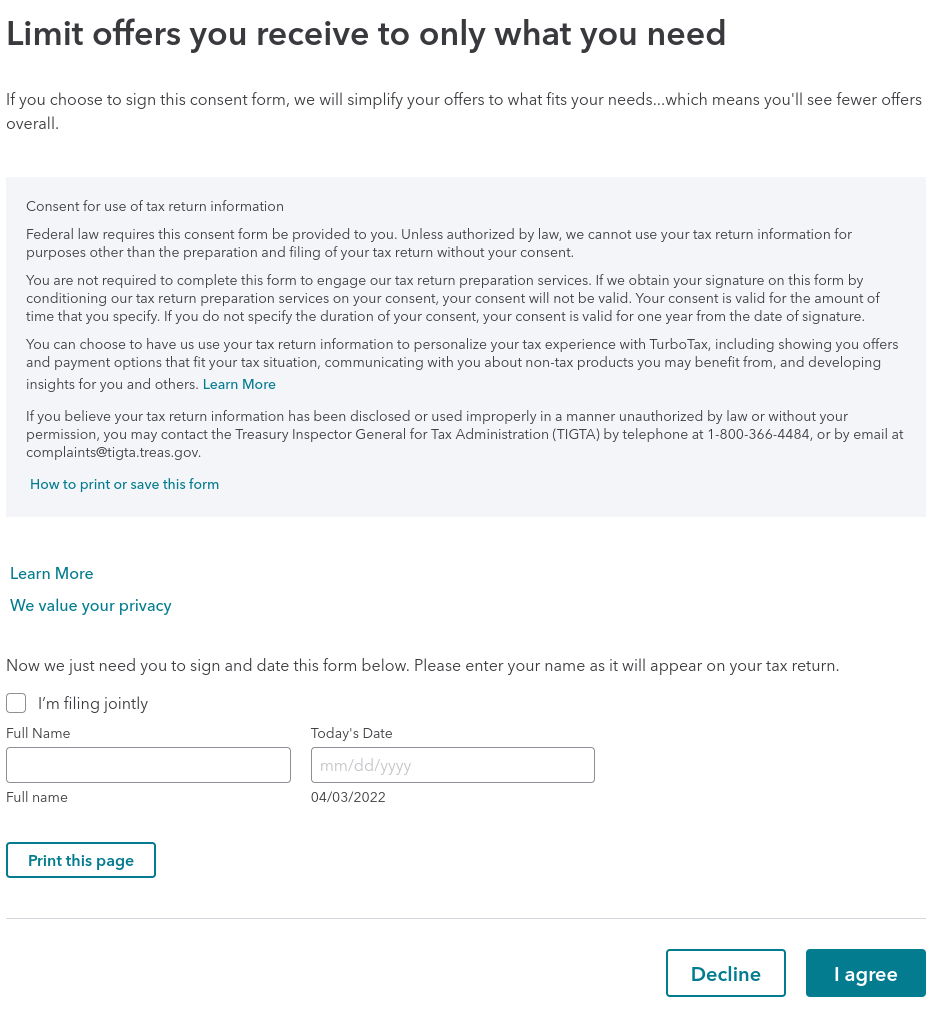

Oh, and TurboTax wants to get its hands on all the information it can:

Pricing

The open-source options are, unsurprisingly, free of cost.

TurboTax

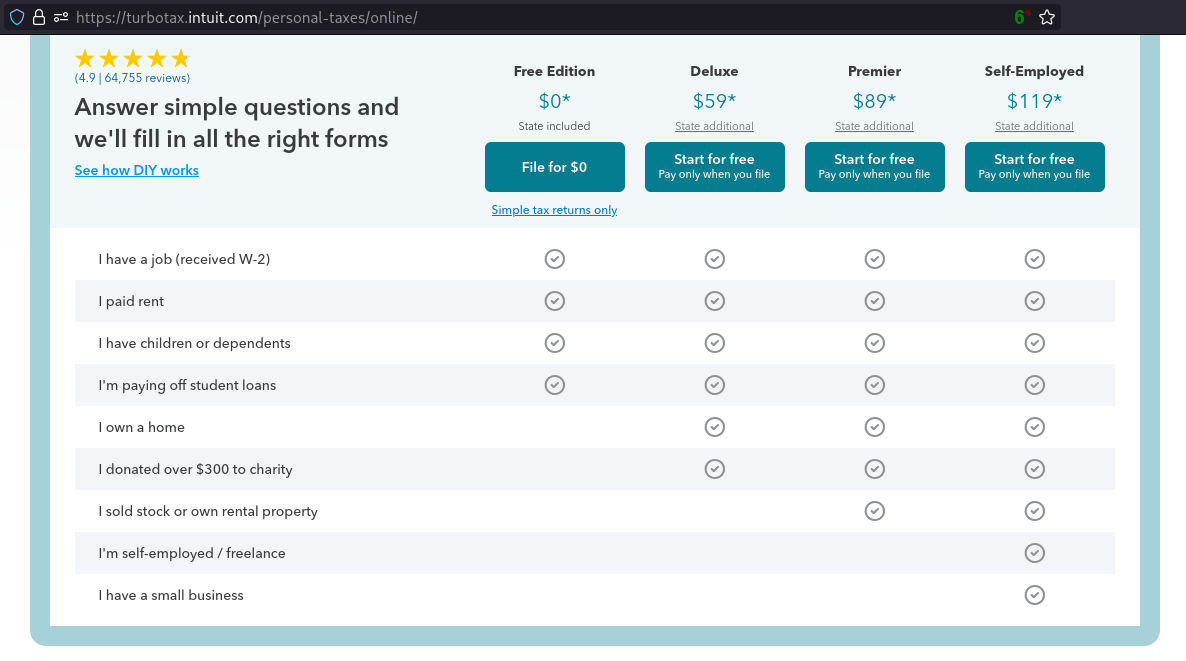

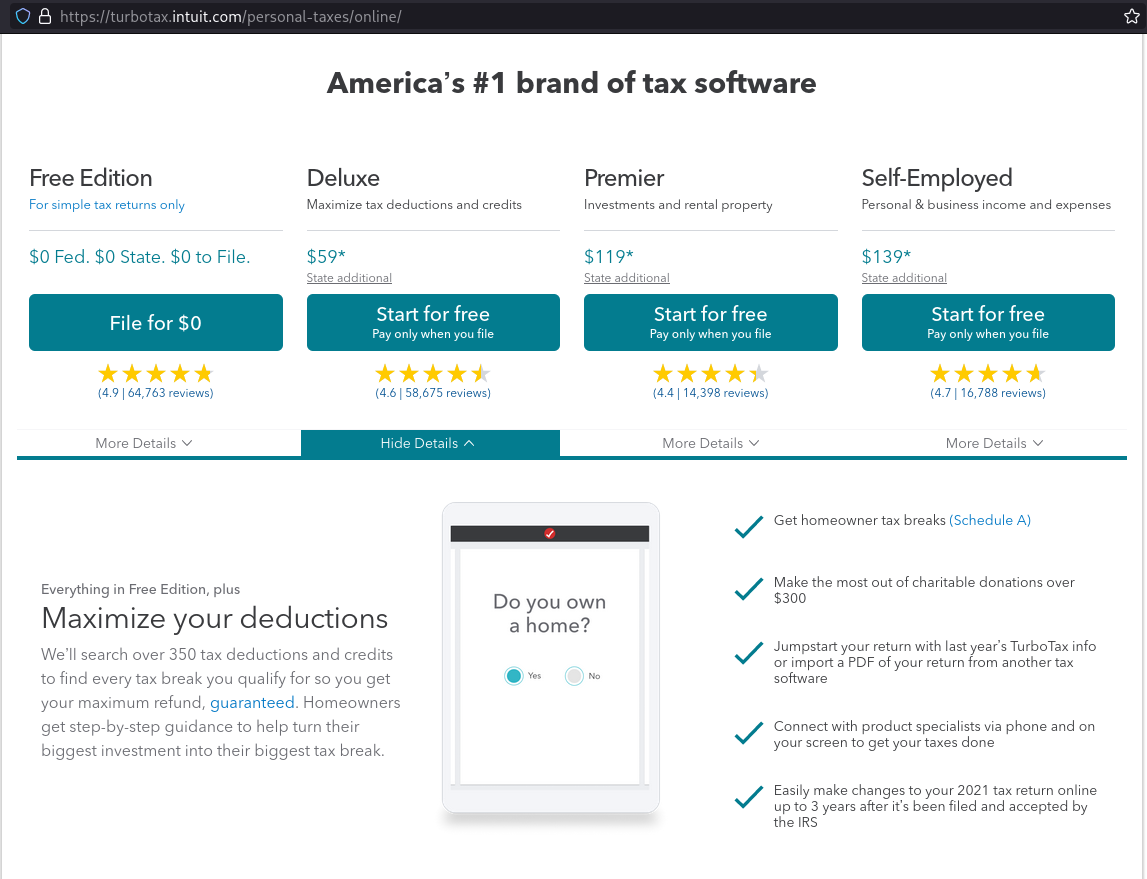

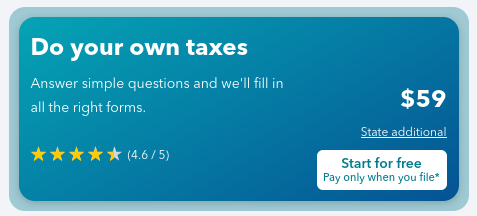

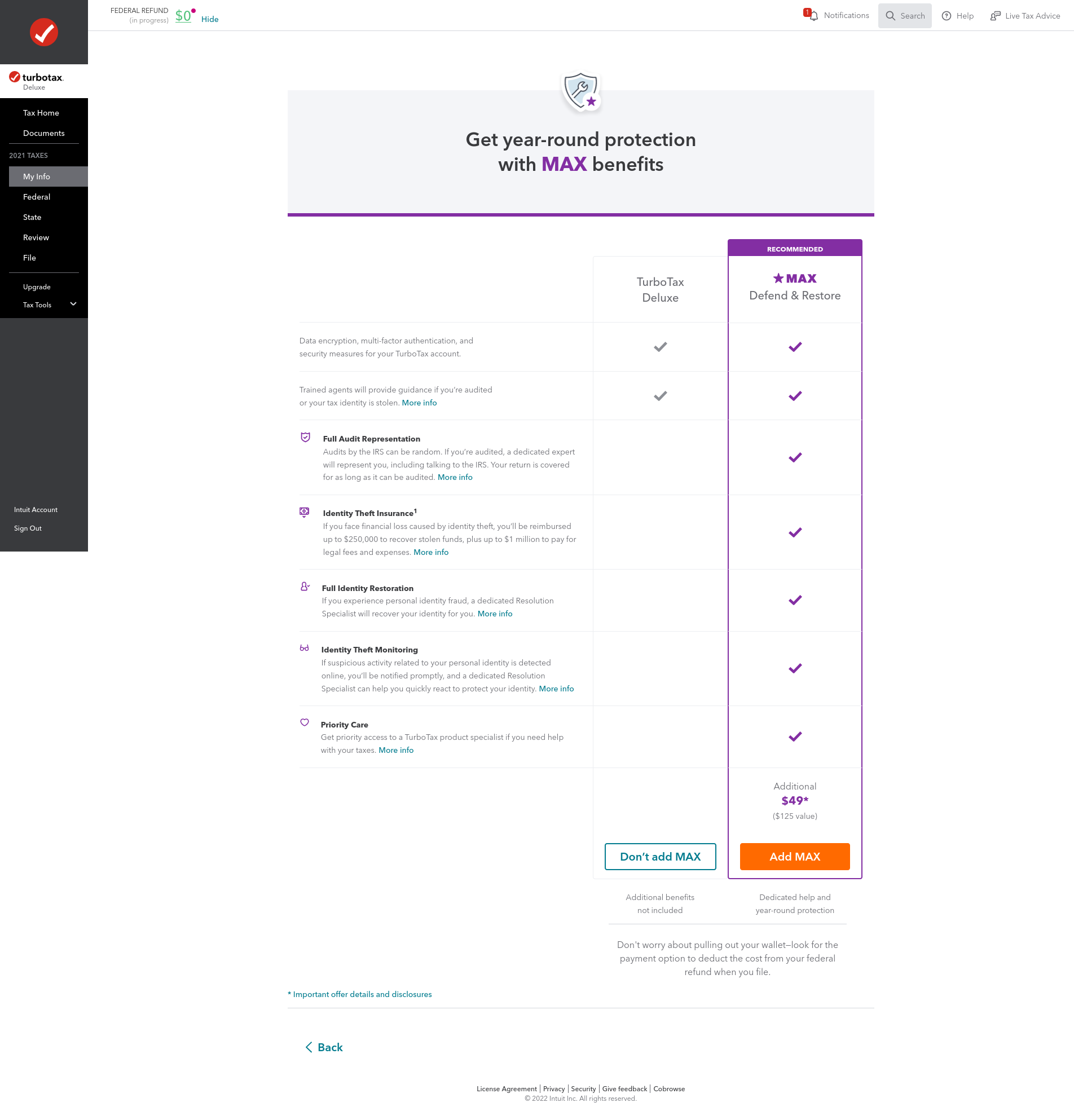

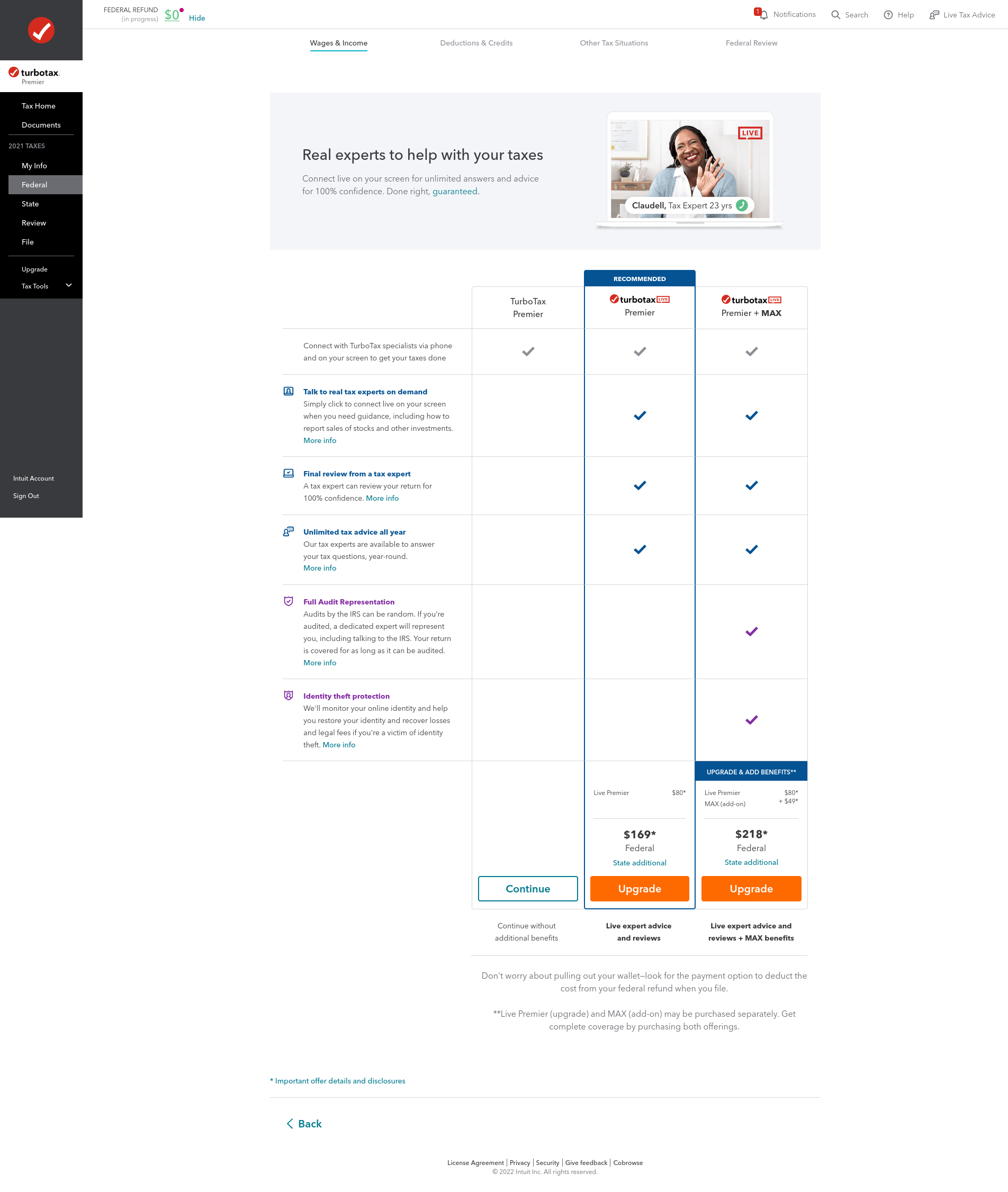

TurboTax provides a questionnaire that helpfully slots you into one of their product ranges. (“Expert help as you go” (“Get unlimited help from tax experts and a review before you file.”) and “We do your taxes for you” (“A tax expert will prepare, sign, and file your taxes for you.”) are a substantial additional cost.)

I was immediately put off to discover that their pricing is different whether or not you’ve already created an account. (I have notes that they also had a $695 Deluxe price listed somewhere, but was unable to find that. Might be an error on my part, or that I wasn’t able to reproduce the set of conditions for which they quote that particular price point.) Note the difference in the Premier and Self-Employed price tiers:

Without an account:

These prices, too, are pretty deceptive; they fairly clearly advertise the cost as the federal cost—and oh, by the way, it’s $50 extra to file your state taxes too. (I suppose this is reasonable in states that don’t have a state income tax, like Washington, Florida, and Texas; those states will just pay the quoted base fee.) After seeing this, I’d expect to pay $59, but the real cost is $108 once you add the $49 state filing fee on:

They do have a free offering, but it’s pretty limited. From Intuit’s website:

A simple tax return is Form 1040 only.

Situations covered in TurboTax Free Edition include:

- W-2 income

- Limited interest and dividend income reported on a 1099-INT or 1099-DIV

- Claiming the standard deduction

- Earned Income Tax Credit (EIC)

- Child tax credits

- Student Loan Interest deduction

Situations not covered in TurboTax Free Edition include:

- Itemized deductions

- Unemployment income reported on a 1099-G

- Business or 1099-NEC income

- Stock sales

- Rental property income

- Credits, deductions and income reported on schedules 1-3

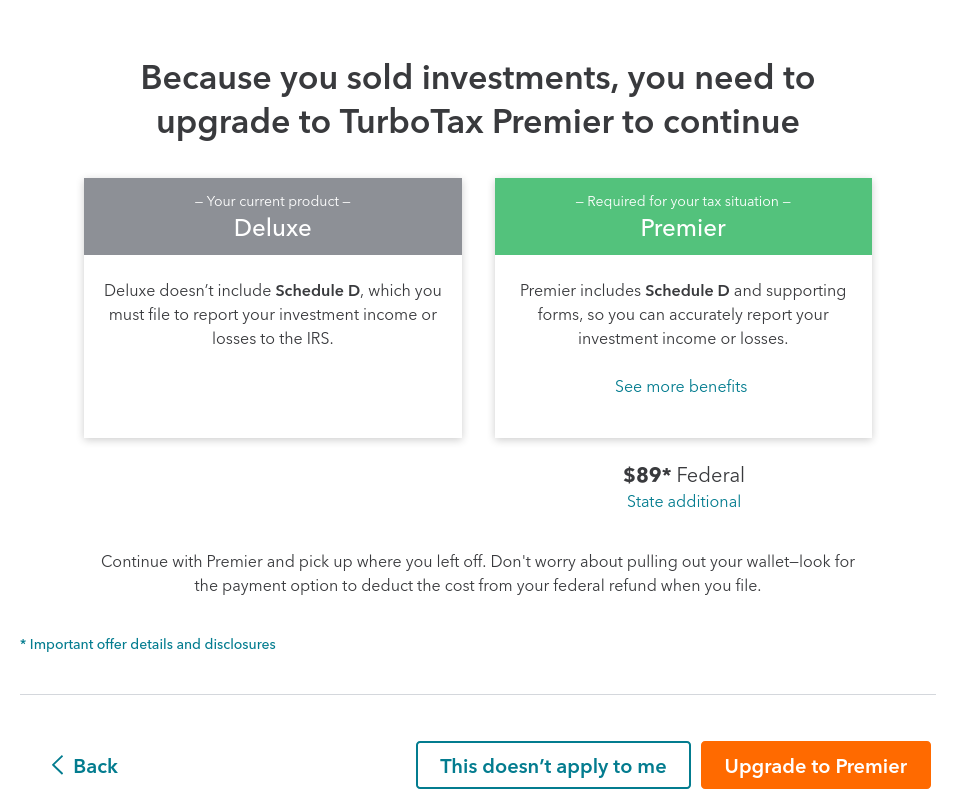

Since I participated in Pearson’s Employee Stock Purchase Program, I would have needed to pay for the $89 Federal/$49 State/maybe additional hidden fees? for Premier:

FreeTaxUSA

FreeTaxUSA, as the name implies, allows you to fill out your federal returns for free, and charges $15 for your state return.

They participate in the Free File program, but only up to an AGI of $41,000, and they do make that page rather difficult to find—it’s not linked to from their home page at all.

OLT.com

OLT.com offers free federal and state tax returns up to a $73k AGI cap. Above that, it’s $9.95. They also have a $7.95 premium edition that offers phone/chat support and audit support.

Pricing Summary

I really don’t understand why Intuit draws a 5-10x premium over the other providers. Their service is somewhere between somewhat better and slightly worse depending on which metric you go by; certainly not 5-10x better!

| Service | Cost (federal) | Cost (state) | Cost (if eligible for Free File) | Free File AGI Cap |

|---|---|---|---|---|

| UsTaxes.org | $0 | $0 | $0 | N/A |

| OpenTaxSolver | $0 | $0 | $0 | N/A |

| TurboTax | $0-$300+ | $49.99+ | N/A | No Free File Offer |

| FreeTaxUSA | $0 | $14.99 | $0 | $41k |

| OLT.com | $0 | $9.95 | $0 | $73k |

Results Summary

Turns out, especially for fairly straightforward returns like mine, most services do a pretty comparable job. Each paid service got me the same return on each form to the dollar. OpenTaxSolver got me the same federal return after a few attempts, and UsTaxes.org offered me a $47 lower refund thanks to not supporting deductions for line 12a.

| Service | Federal return | State Return | M1PR |

|---|---|---|---|

| UsTaxes.org | $(X-47) | N/A | N/A |

| OpenTaxSolver | $X | N/A | N/A |

| TurboTax | $X | $Y | $Z |

| FreeTaxUSA | $X | $Y | $Z |

| OLT.com | $X | $Y | $Z |

(Dollar values omitted for privacy reasons.)

User Experience

UsTaxes.org

Definitely the best UI, narrowly edging out TurboTax. They use Material UI, which feels very familiar to me, and have clearly put thought into things like tab indexing, so navigating around feels very natural. I didn’t try filling it out on a mobile device (I’m not that much of a masochist), but their mobile UI seems very passable as well.

There’s very little friction to getting started: No account to create, no terms of service or privacy policy to agree to, no application to install; just visit the website and get started.

Also, I noticed it was a bit quicker to run through my forms too. Many of the other services had me copying over data from every box of every form I received, but UsTaxes.org seemed to only have me extract the relevant bits.

There’s an open issue tracking progress on allowing federal return submission through FreeFileFillableForms, but otherwise UsTaxes.org expects you to print out and mail in your forms, which isn’t nearly as convenient as e-filing.

OpenTaxSolver

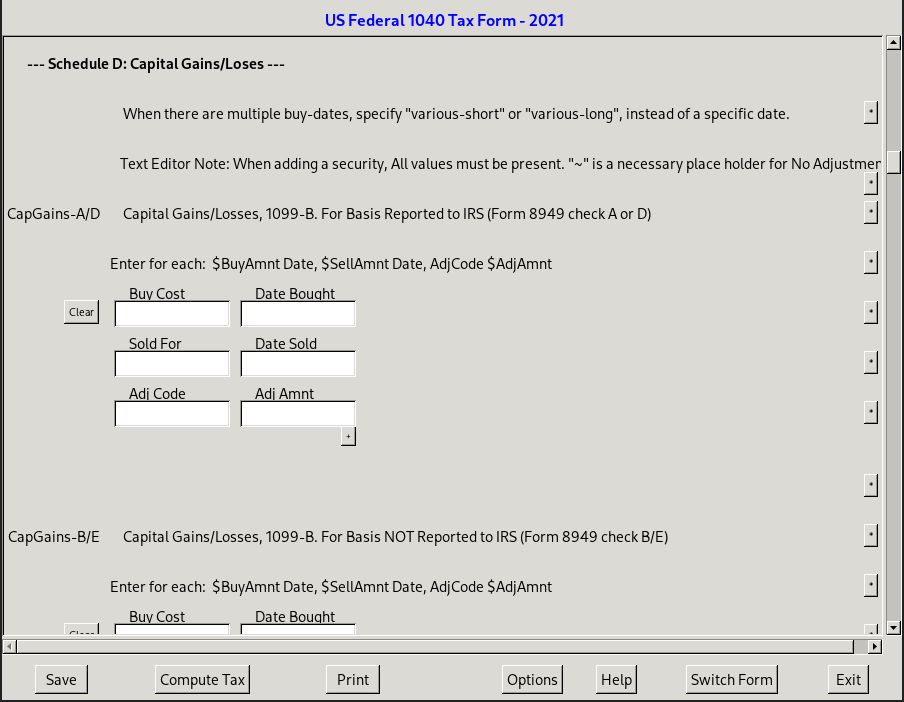

OpenTaxSolver was the only piece of software with which I made mistakes – and I did it last, so I knew what I was looking for. I had to go back twice and correct values I’d omitted or misplaced. Unfortunately, this does just speak to the confusing interface of OpenTaxSolver. As its website says, it’s definitely targeted at people who have a high degree of familiarity with the forms it’s filling out for you, though at that point I’m not sure why I wouldn’t want to just fill out forms myself.

Here’s one place I messed up: I received a 1099-B from Pearson’s employee stock purchase plan. The 1099-B, and every other software, refers to these fields, among others:

- Description

- Date acquired

- Date sold

- Proceeds

- Cost or other basis

- Type of gain/loss (short or long term)

Here’s OpenTaxSolver’s interpretation of those fields:

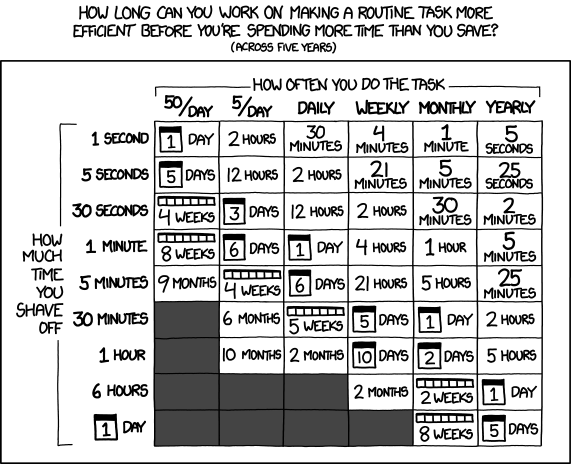

I have no doubt that if I had to file my taxes weekly or even monthly, I’d be using OpenTaxSolver. However, I’m not prepared to learn a domain-specific language (even if it’s super cool!) for a set of forms I have to fill out once annually.

OpenTaxSolver expects you to print and mail your tax returns.

OLT.com

Form fields are a little bit odd. Certain elements edit hyphens and such in with

JavaScript. The phone number fields are all formatted as two fields; one for the

area code, and another for the exchange and subscriber number (so a number like

(320) 555-1212 would be represented in two fields: [ 320 ][ 5551212 ]),

which led to me reliably either typing all ten digits of phone numbers into the

area code box, or hitting tab again after the exchange code (555 in this

example). The tab order for addresses is “Address Line”, “ZIP Code”, “City”,

“State”, which often leads me to begin typing the city in the ZIP field. (This

is sort of reasonable, though, since they do attempt to auto-fill the city and

state from the ZIP Code.)

I mistakenly clicked to add a form which I didn’t have. The site wouldn’t allow me to move on from that page until I’d filled out the title and the TIN, which, of course, I didn’t have! It did let me log out and log back in, which apparently reset the session sufficiently to allow me to continue.

FreeTaxUSA

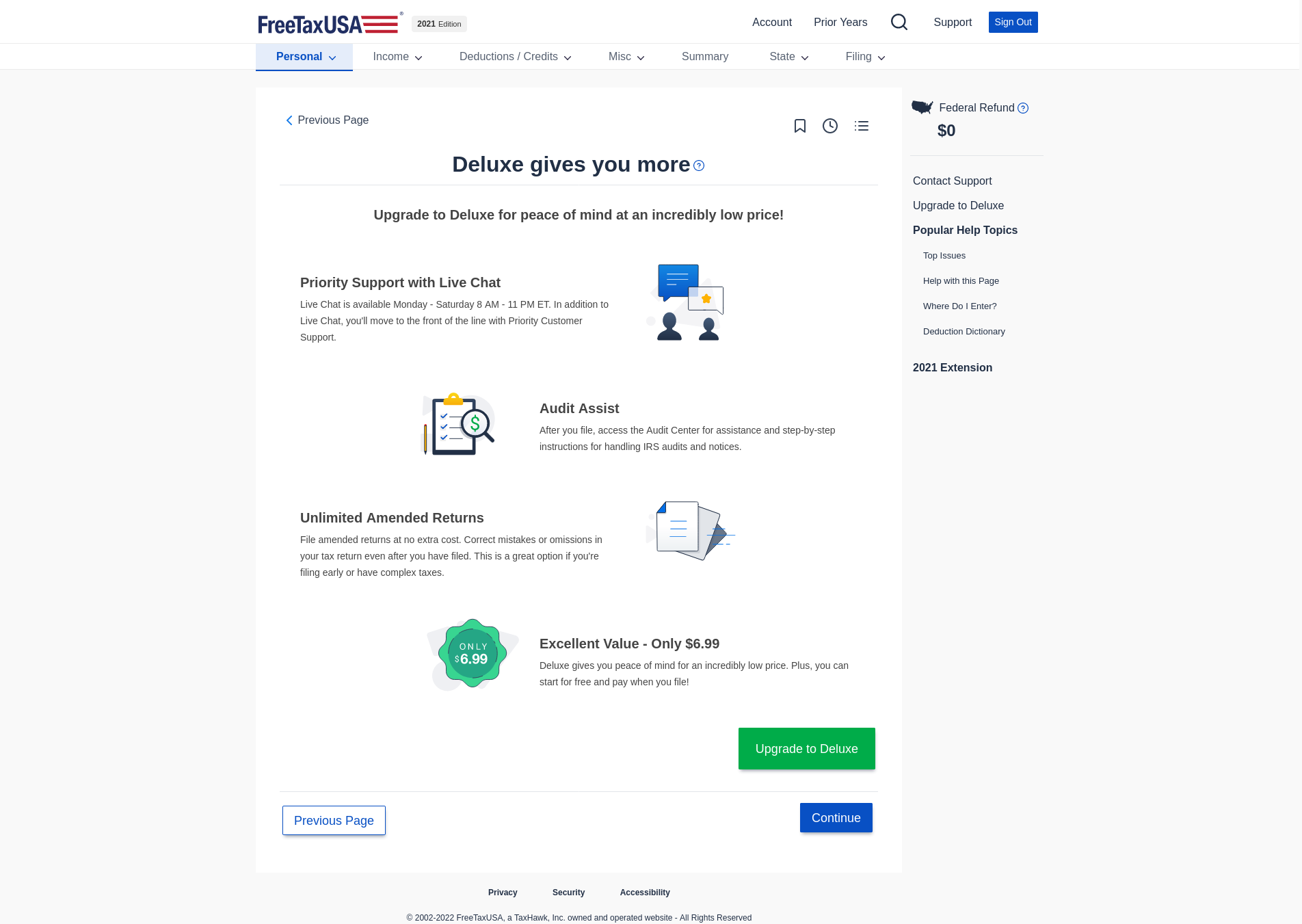

Pleasant to use. Not over-the-top fancy like TurboTax, nor as barebones as OLT. I got a single attempt to upsell during the process, and likely would have had one or two more if I attempted to file with them. (However, I find a $7 Deluxe package a lot less offensive than the several-hundred-dollar upgrades that Intuit tries to push!)

TurboTax

Prompts me to enter a phone number (skippable, but not obvious) every time I log in.

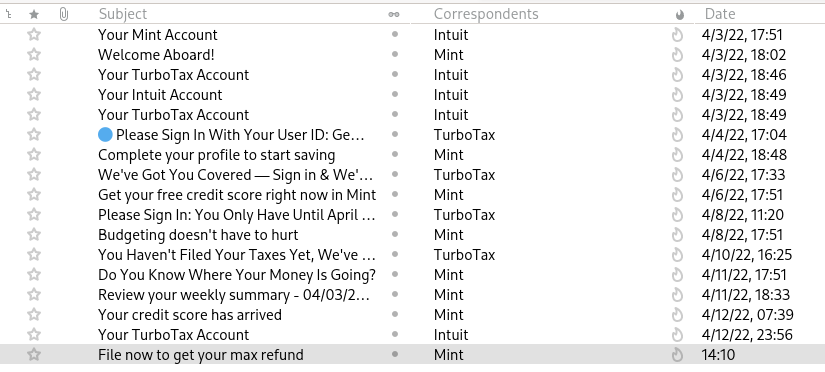

Spams me with email after signing up. It’s possible I’m a dummy, and somehow clicked something to sign me up for Mint, but I never intentionally navigated to Mint, so these emails are just all unsolicited Intuit spam:

Auto-import is…almost nice? Except I have to enter employer TIN, Box 1 of my W-2, and the box d (“Control number”) of my W-2, and then proofread—at this point, I might as well just fill in all the information myself! I don’t consider this much of a benefit at all; I don’t really think it saved me any time, though it was able to import the majority of the information I needed.

The number of animations, interstitials, and aggressive upgrade prompts I had to sit/click through really tested my patience. It’s incredible they’re leading the market with such a user-hostile product.

How much legal gunk I had to read to use each service

| Service | cat privacy_policy terms_of_use | wc (lines, words, characters) |

|---|---|

| UsTaxes.org | 0 |

| OpenTaxSolver | 0 |

| TurboTax | 1006 24328 155006 |

| FreeTaxUSA | 183 6901 43255 |

| OLT.com | 323 8250 52270 |

| Franz Kafka’s Metamorphosis (for scale) | 2266 25094 142017 |

So TurboTax’s privacy policy and terms of use is both longer and more boring than Kafka’s Metamorphosis. Hmm.

So, is open-source tax software ready?

Honestly, as much as I’d like to say otherwise, no, it’s not. If your tax situation is exceptionally simple, then you can use UsTaxes.org—but TurboTax’s free product should cover most of those cases too, and will allow you to e-file. If you’re eligible for Free File, either OLT.com or FreeTaxUSA is perfectly fine.

If you have a lot of patience and interest in understanding what you’re doing, you can use OpenTaxSolver—but you can also fill in the forms yourself, and again, FreeFileFillableForms will allow you to e-submit here.

The great thing about open source software is that I can contribute! I’ve been working on some PRs to UsTaxes.org (which unfortunately didn’t make it in before tax day, but may help late filers), and I’ve been playing around with getting Minnesota’s state returns supported. Hopefully, in another year or two, it will be in a state where I’ll feel comfortable recommending it to everyone. And, of course, the sooner TurboTax dies a flaming death, the happier I’ll be!

-

Unless you work in the tax industry, you probably don’t need citations on this one. But there’s a ton of excellent writing out there!

From NPR:

- Federal Trade Commission accuses Intuit of deceptively advertising TurboTax as free (2022)

- TurboTax Maker Linked To Fight Against ‘Return-Free’ Tax System (2014)

- H&R Block, TurboTax Accused Of Obstructing Access To Free Tax Filing (2019)

- Opposition Blocks Return-Free Tax Filing In U.S. (2013)

From ProPublica’s Series “The TurboTax Trap”:

- Inside TurboTax’s 20-Year Fight to Stop Americans From Filing Their Taxes for Free (2019)

- FTC Sues to Stop “Deceptive” TurboTax “Free” Ad Campaign (2022)

- And many more excellent articles

Elsewhere:

- The LA Times: California tried to save the nation from the misery of tax filing — then Intuit stepped in (2021)

- TechCrunch: TurboTax Maker Funnels Millions To Lobby Against Easier Tax Returns (2013)

- The Verge: TurboTax maker lobbies to stop the government from making your returns easier (2013)

- On HN every March-April

-

One interesting thing I picked up this time around is that the IRS will send you alternate forms of communication. Besides the usual standard print letters, there’s large print and braille, both of which I’d expect, and the option to send MP3 files and text/braille files on a USB drive, which I did not expect!

From https://www.irs.gov/forms-pubs/about-form-9000:

↩︎I elect to receive written communications from the IRS in the following accessible format. Check only one. Forms with more than one box checked will not be processed.

- 00 Standard Print (Cancels prior election)

- 01 Large Print

- 02 Braille

- 03 Audio (MP3)

- 04 Plain Text File (TXT)

- 05 Braille Ready File (BRF)

Note: You will also receive a standard print copy.

-

Compiling the source for OpenTaxSolver did give me my first introduction into

git-svn, which is pretty great!↩︎git svn clone https://svn.code.sf.net/p/opentaxsolver/SrcCodeRepo/ opentaxsolver -

% du -hs opentaxsolver/trunk/* 1016K opentaxsolver/trunk/OTS_2017 7.2M opentaxsolver/trunk/OTS_2018 6.9M opentaxsolver/trunk/OTS_2019 7.0M opentaxsolver/trunk/OTS_2020 9.0M opentaxsolver/trunk/OTS_2021Compare this to USTaxes.org’s software, written in Javascript:

% du -hs node_modules 656M node_modules % find node_modules | wc -l 93728Plus Rust stuff, for Tauri, not known for its compile speed.

Building OpenTaxSolver didn’t make me install or download anything except the

gcc/maketoolchain, andgtk+-2.0, all of which I already had installed, and occupies more than an order of magnitude less disk space. ↩︎ -

Nice. ↩︎